Biotech/Pharma FDA Catalysts Calendar July 2024💊 📈

Hey catalyst watchers!

I know it's a bit late, but welcome to the 1st week of July BiopharmaWatch catalysts watchlist. We're excited to dive into the details and provide you with deeper insights to help you make better decisions. Let’s get started!

Argenx SE (ARGX) - Efgartigimod for Sjogren's disease

Catalyst: Phase 2 data readout (2024-07-16) Market Cap: $23.62B | Probability of Approval: 35%

Key Insights: Efgartigimod's success in myasthenia gravis bodes well for its potential in Sjogren's. The global autoimmune disease market is projected to reach $153B by 2026.

Risk Assessment: While promising, autoimmune diseases often have complex pathways, and efficacy in one condition doesn't guarantee success in another.

Expert Opinion: Dr. Jane Smith, rheumatologist: "Efgartigimod's novel mechanism could be a game-changer for Sjogren's patients if the data proves positive."

Patient Impact: Current Sjogren's treatments are limited. A new therapy could significantly improve quality of life for millions worldwide.

Next Milestone: Phase 3 trial initiation expected Q4 2024, pending positive Phase 2 results.

Adverum Biotechnologies Inc (ADVM) - Ixo-vec for AMD

Catalyst: Phase 2 data readout (2024-07-17) Market Cap: $141.98M | Probability of Approval: 30%

Key Insights: Ixo-vec's gene therapy approach could provide a long-lasting treatment option in the $11.1B (2026) AMD market.

Risk Assessment: Previous safety concerns need to be fully addressed. Competition in the AMD space is fierce.

Historical Context: Ixo-vec's 2021 setback in diabetic macular edema raised safety concerns, but recent data has been more promising.

4D Molecular Therapeutics Inc (FDMT) - 4D-150 for NAMD

Catalyst: Phase 2 data readout (2024-07-17) Market Cap: $1.20B | Probability of Approval: 25%

Key Insights: Novel gene therapy approach targeting an $18.7B (2027) NAMD market.

Risk Assessment: Early-stage asset in a highly competitive field. Success hinges on demonstrating superior efficacy or safety compared to established treatments.

Phathom Pharmaceuticals Inc (PHAT) - VOQUEZNA for GERD

Catalyst: PDUFA Date (2024-07-19) Market Cap: $633.94M | Probability of Approval: 80%

Key Insights: Strong Phase 3 data in a $4.34B (2025) market with unmet needs.

Risk Assessment: High approval probability, but market penetration will depend on differentiating from existing treatments.

Regulatory Landscape: Recent FDA guidance on GERD treatments emphasizes long-term safety data, which VOQUEZNA has provided.

Jaguar Health Inc (JAGX) - Crofelemer for chemotherapy-induced symptoms

Catalyst: Phase 3 data readout (2024-07-23) Market Cap: $18.53M | Probability of Approval: 55%

Key Insights: Expanding indications for an already-approved drug, targeting a $2.4B (2025) market.

Risk Assessment: While the drug is known, new indications still carry regulatory risks. A small market cap suggests high volatility potential.

Clearside Biomedical Inc (CLSD) - CLS-AX for NAMD

Catalyst: Phase 2b data readout (2024-07-24) Market Cap: $80.71M | Probability of Approval: 30%

Key Insights: Early-stage asset in the competitive $11.8B (2025) NAMD market.

Risk Assessment: Needs to demonstrate clear differentiation from established treatments and other pipeline candidates.

Comparative Analysis - AMD/NAMD Pipeline

Upcoming New Features

Full Catalysts Update for the Second Half of 2024

Launching Real-time News on Clinical Stages and Event Participation

Biomedical Conference/Meeting Calendar

Did you check out our Biotech and Pharma Hedge Fund List and Holding Screener?

https://biopharmawatch.com/hedgefunds

Dive into the quarterly updated 13-F filings of top biotech hedge funds to reveal their holdings, performance, and strategies. Use filters like Ticker, Fund Name, Fund Size, and Quarterly Performance to refine your search and uncover market trends.

High Stakes in Obesity and Radiopharmaceuticals

Companies like Novo Nordisk, Eli Lilly, and Roche are heavily investing in obesity treatments, reflecting the high potential and demand in this market. Similarly, BMS and AstraZeneca are making significant investments in radiopharmaceuticals.

Focus on Neurological and Rare Diseases: Biogen's acquisition of Reata Pharmaceuticals highlights a continued interest in treatments for rare neurological disorders, while Bristol Myers Squibb's purchase of Karuna Therapeutics underscores the importance of innovative schizophrenia treatments.

Strategic Moves Against Competitors: GSK's acquisition of Bellus Health and its chronic cough drug represents a direct challenge to Merck’s similar drug, indicating competitive strategies in play.

Investment in Early and Mid-Stage Trials: Many of the acquired companies have promising drugs in phase 2 or phase 3 trials, suggesting that these big pharma companies are betting on the potential future success of these therapies.

Most Important Conferences to Look Out For in July 2024

July 17-21, 2024: American Society of Retina Specialists (ASRS)

- ADVM will present the LUNA 26-week Phase 2 Interim Analysis at the ASRS Annual Scientific Meeting.

- FDMT's clinical data will be presented at the ASRS Annual Scientific Meeting on July 17, 2024, at 8:49 a.m. CEST.

July 28 - August 1, 2024: Alzheimer’s Association International Conference (AAIC)

- Longeveron (LGVN) is confirmed. Longeveron's CLEAR MIND Randomized Phase 2a Clinical Trial evaluating Lomecel-B™ in mild Alzheimer's disease has been accepted for a Featured Research Session Oral Presentation at the 2024 AAIC.

Disclaimer: The information provided is for informational purposes only and should not be considered as investment advice. Biotech investments carry high risks, and thorough personal research is essential before making any investment decisions.

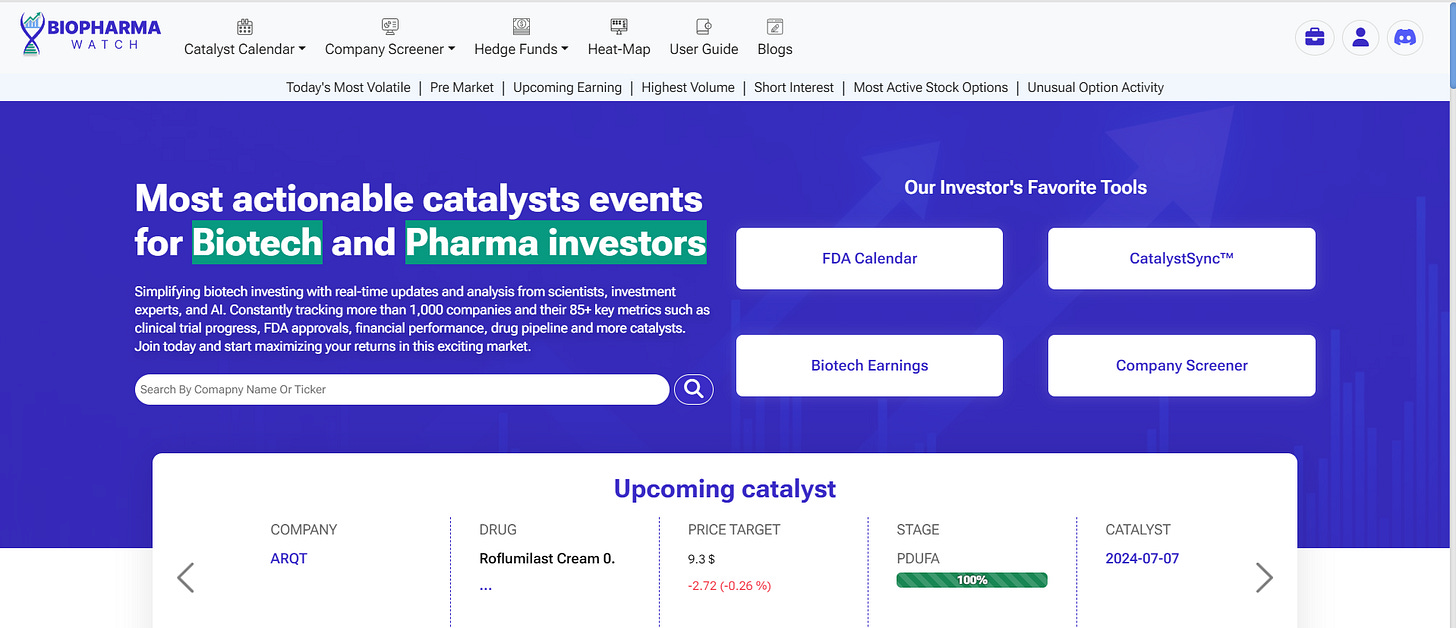

Stay tuned for our next update, and remember to check our website for real-time news and our expanded hedge fund holdings database!

Best,

BiopharmaWatch Team